WealthHub, a cloud-based computing platform mounted on Salesforce®, today announced that it has closed a favorable seven-figure strategic investment targeted to accelerated growth. Terms of the investment were not disclosed. WealthHub, a privately-held company, founded in 2013, with offices located in the Philadelphia suburb of Conshohocken, PA, provides users with a single platform that integrates multiple applications to effectively and efficiently manage all their day-to-day responsibilities in the wealth management industry.

WealthHub’s growth strategy, supported by Salesforce, is to expand its presence in the wealth management marketplace, especially directed toward trust companies, estate attorneys, banks, registered Investment Advisors and family offices.

“The world has gone digital, and digital has become the new wealth management industry mandate to meet client expectations,” said C. Richard Corl, CEO of WealthHub. Key benefits of the platform include an integrated experience that promotes client confidence, reduces potential client flight risk and increases productivity and profitability. Regardless of age, wealth level, geography or need for advice, high net worth individuals are demanding digital capability from the wealth management industry and two-thirds would consider an alternative provider by leaving their current wealth management firm if an integrated experience is not provided. WealthHub is an innovative trust and investment administration solution breaking the existing paradigm, where old legacy back office outdated systems are dinosaurs. WealthHub has redefined the paradigm shift in wealth management operations, changing the way wealth management organizations will operate going forward.

About WealthHub Solutions

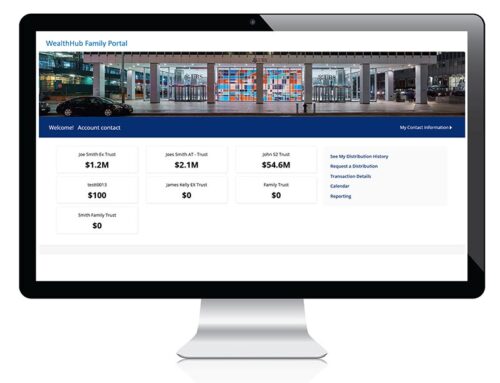

WealthHub Solutions (WealthHubSolutions.com) is the leading provider of enterprise software for fiduciary management. WealthHub’s cloud-based platform for trust company administration delivers an end-to-end solution for trust officers and other fiduciaries that fully integrates investment data and reporting with automated workflow, client management and prospecting, task scheduling, document management, and compliance. The WealthHub platform creates real operational savings for trust companies by improving trust officer productivity—while enhancing the customer experience.