WealthHub Trust Management Software

The only CRM software built specifically for trust management of day-to-day activities

SCHEDULE A DEMO

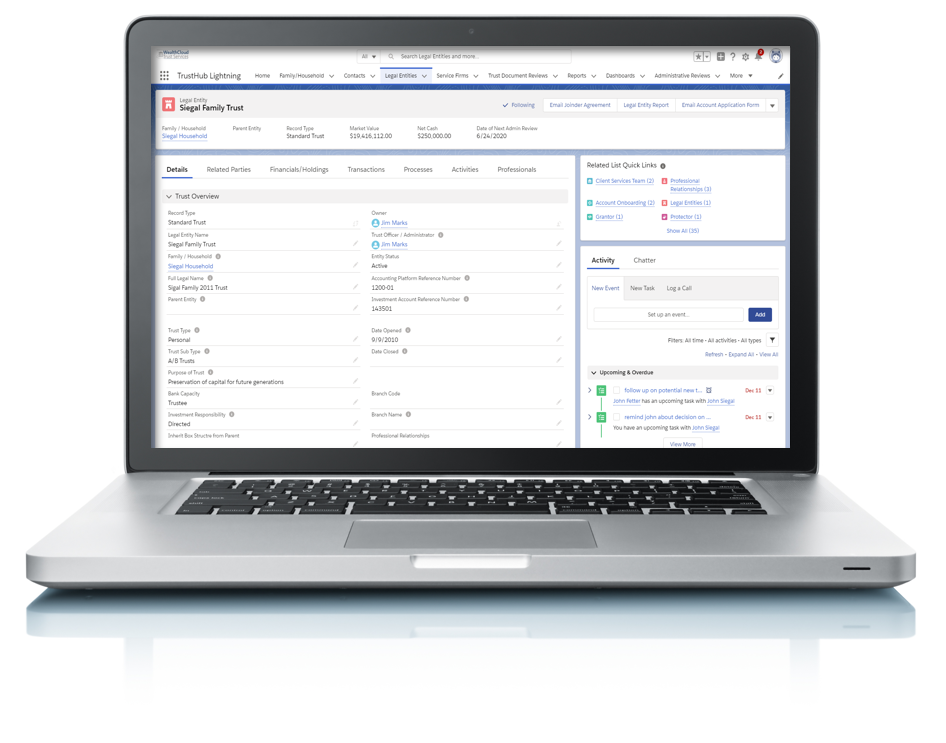

All critical information is available at your fingertips for efficient management.

WealthHub’s trust administration software combines a state-of-the-art CRM with trust-specific business process management to deliver a unique platform for trust and family office administration.

- Automates the administration of trusts and family offices

- Built on top of Salesforce, delivering best of breed CRM functionality

- Creates a “single source of truth” for all customer information

- A single interface to access all your client relationship information

ORGANIZE

Digital Information

- Legal Entity Details

- Documents

- Holdings & Transactions

- Related parties: beneficiaries, co-trustees, etc.

- Contact info for family members, advisors, vendors etc.

AUTOMATE

Workflows & Processes

- Distributions

- New Entity Onboarding

- New Account Onboarding

- Disbursements

- Wire Transfers

- Other Approval Processes

COMMUNICATE

Internally & Externally

- Record and recall meetings, calls emails

- Generate and publish reports and lists

- Group chat

- Produce LOAs and other communications automatically

WealthHub ensures that everyone understands each other.

Perfectly.

Built on top of Salesforce, WealthHub makes available Salesforce’s state-of-the-art business development, communications, and organizational capabilities.

Eliminate paper and PDFs for approval of annual reviews or new accounts. When a review is completed, WealthHub sends email notification to approver or committee with link back to underlying information. Rejections are delivered back to submitters along with requests for clarification or more information. Approvals are recorded with records automatically locked down for future audit or review. No more stacks of paper waiting for committee meetings to review.

WealthHub connects directly with your trust accounting system vendor to extract position, balance, and transaction information on a nightly basis. If you have accounts held away or don’t use a trust accounting system, no problem. We work with an industry-leading data aggregation partner to collect your data. Full historical information is maintained, allowing you to see cash balances, net worth, or transactions sliced by family, trust, manager, account—or however you would like.

Think of this as CRM for Trusts. Key information on the trusts you administer is all available in one place. Trust type, domicile, tax status, key provisions, beneficiaries, trustees, protectors, and more. You can track nested ownership of LLCs, other trusts, or whatever asset the trust owns. Legal entity types managed include trusts, LLCs, corporations, partnerships, endowments, foundations, estates, IRAs, agency accounts, with information specific to each and reporting available on each entity or on a rollup basis.

All your trust documents are always available within WealthHub. You can search, print, or send them, even share them with your clients, without leaving the WealthHub platform. Presented on a cost-effective basis in the cloud via Box.

WealthHub automatically keeps track of progress as new accounts are onboarded, recording dates and approvals for items like KYC, investment review, document review, successor trustee risk evaluation, custodian account opening, funding and more. Management reporting gives insight into exactly how long each step is taking, where bottlenecks occur, and how individual staff are keeping up.

You can implement eSignature using DocuSign through WealthHub so that LOAs, distribution approvals, or any other document can be legally signed conveniently and quickly online.

Reviewers are walked step by step through reviews so that no items are missed, all reviews are done on a consistent compliant basis, and records of reviews are always available for auditors or regulators. Reviews requiring approvals by managers or committees go through our automated approval process. You can use our templated investment, document, KYC, successor trustee, account opening, or account acceptance reviews or use your own.

Ticklers can be set up on a one-time or recurring basis. Or WealthHub will remind you if a payment is about to be due, tax returns are due, or a review is overdue. Tasks can be assigned or tracked. And all this information, including emails, moves smoothly back and forth between WealthHub and Outlook or other email client.

Making distributions just got a lot easier. Set up either one-time or recurring distributions. See cash balances and trust distribution provisions. Get approvals via automated process instead of waiting for a committee meeting. Send LOAs to managers to disburse funds using automated templates and e-signature.

Hedge and private equity fund investments are a key aspect of high net worth investment management. So why keep treating them as memo fields in your accounting system? WealthHub allows you to track and report on current and historical market values, contributions, distributions and commitments for funds.

Do trust assets under your fiduciary care include real estate, boats, planes, jewelry, art or other collections? No problem, WealthHub can help you manage them by organizing key property information (specific to each asset type) and documents, keeping track of service providers, and reminding you of payments for property taxes, HOA dues, insurance, FBO or marina fees and more.

If you are paying bills for client, you can enter and manage bills and get them approved by clients. And coming shortly, you will be able to pay bills electronically through WealthHub.

WealthHub’s Trust Administration Software is an end-to-end solution for effective trust administration. Built on top of Salesforce, WealthHub trust management software organizes fiduciary activity with a single interface providing:

- Integrated cloud-based document management

- Access to investment and bank account information

- Tracking of payments, tax filing, and other key tasks

- Management of multiple asset types

WealthHub’s security architecture ensures you will always have access to your data on our platform—and no one else will.